The thought of purchasing a home can be daunting and have you clouded with doubts and fear of ‘can I afford this?’ Approaching a lending agency or bank can be even more intimidating as new worries of homeownership begin to sink in.

At the HomeOwnership Center, we stay with you every step of the way – from assessing your readiness to buy a house to that wonderous closing day.

We work with you on lending options, support you through times of doubts, guide you on how to boost your credit score and celebrate when you finally become a homeowner.

When you begin working with the HomeOwnership Center, you’ll meet with our homeownership advisor Jami Stewart. Jami is full of warmth and information and will help you determine the next steps in your homebuying journey.

In our latest blog, Jami helps ease any hesitation by explaining the initial steps of working with HOC.

What is the first thing an interested customer should do?

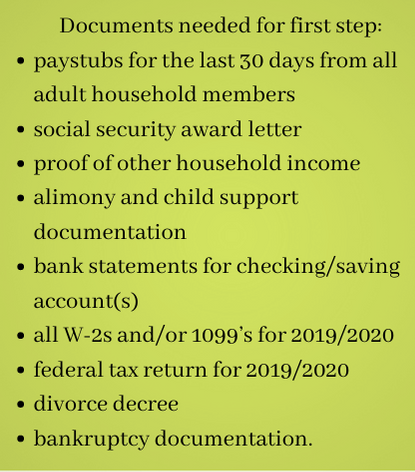

If the customer has internet access, the first steps are going to be for them to log on to our website and fill out the ‘get started’ intake form. It’s going to ask for their contact info, budget info, employment — lot of information like that so we can get a baseline and figure out which paperwork to gather from then on.

They’re also going to submit their payment for their credit report.

If they don’t have internet access, they can give us a call, and I can mail them out the intake form.

Does it cost to get started?

The only cost for the initial service is going to be the $22 per applicant for their credit report.

After you’ve received the customer’s profile, what happens next?

When they submit that initial intake, I’m going to get in contact with them by either email, call or text. We’ll then go over the paperwork and I’ll explain what the process will look like for them.

We’ll then set up a phone call appointment to get into more details about their income, current credit score and recommendations or things that need to be done to get them in the right direction or to move forward with the next process. This appointment takes about 30-45 minutes.

You can fill out the online form here.

What kind of information will you provide customers?

After I gather all their paperwork, I will have a better idea of what the next step looks like for them.

I will offer my thoughts on whether it is the right time for the customers to move onto the application process, or if they have some work to do first.

What are your recommendations if a customer(s) is not ready to move forward?

If their credit score needs improvement, I am going to recommend that they resolve any collections. Most of the times if they have collections, their credit score isn’t where it needs to be, so paying off those collections or making payments toward them will normally boost their score.

The next common recommendation is going to be to establish tradelines or just good credit. At HOC, we like customers to have two open and active tradelines for at least 12 months with good payment history.

In the long run, when their negative credit lines are all taken care of, or new credit lines have been established and only good credit is reporting, customers will see an increase in their credit scores.

Although each client’s situation is different, and they may warrant other recommendations, I am eager to help each customer who reaches out to begin the process.

What about if the customer(s) is ready to move forward?

If they’re ready and want to continue working with HOC, they will speak with Tawnya or Chris, our loan specialists. Our loan specialists will give them their options as in what loans they fit into and lets them decide which one they want to go for.

We normally have an idea of which loan they fit better into, but it’s completely up to them. The customer will then move onto the application process.

What would you tell someone who is intimidated to work with HOC?

Customers should know we are relaxed and offer a calming environment in a sometimes stressful and scary process. We are not going to push them into a certain product because it benefits us. We really look out for our people, and we really want to set them up for success.

If you’re considering working with the HomeOwnership Center, please reach out to us at 304-636-9115.