Purchasing a home is stressful especially if this is your first go at homeownership.

It’s an exciting time, for sure, but it can certainly come with worries and doubts.

Luckily for potential homebuyers of North Central West Virginia, the HomeOwnership Center is available to help! There’s a reason we specialize in assisting first-time homebuyers; we know how stressful the process can be, so we stick by your side from initial appointment all the way to closing day!

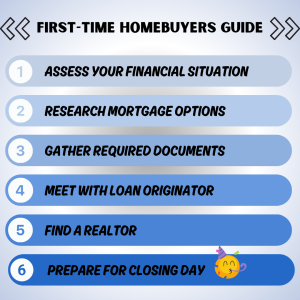

So, you’ve decided you’re ready to become a homeowner, now what?

Assess your financial situation

Take the time to really determine if you are financially ready for this big step. What’s your budget look like? How much “house” can you afford? Is your credit in good standing?

HOC offers Pre-Purchase Counseling to help determine if you are mortgage-ready or if some adjustments need to be made before you should start shopping for homes. Our Home Ownership Advisor will go over your credit report, budget, affordability, and your debt-to-income ratio to ensure you’re taking the right step forward.

Learn more about Pre-Purchase Counseling here.

Research your mortgage options

Of course you should know what lenders are available in your area, but you should also do a bit of research on the loan options that best fit your income, credit and where you want to live

At HOC, we offer loan options for ALL income levels. That’s right. We feel that everyone should have the opportunity to reach homeownership and build generational wealth.

Our loan options include:

– Conventional Home Loan

– FHA Home Loan

– USDA 502 Direct Home Loan

– USDA Guaranteed Home Loan

– Down Payment Assistance

Our Loan Originator can help you go through these options to make sure you feel comfortable with your mortgage loan.

Get Ready for the Mortgage Process

Once it’s been determined that you’re mortgage-ready, you want to prepare to meet with the loan originator who will be processing your loan. Preparation looks like having all your required documents ready and answering any questions your loan originator may have.

HOC’s Loan Originator Chris Vance is a wealth of knowledge and makes each person feel comfortable with moving onto the next steps!

REMEMBER: ASK ANY & ALL QUESTIONS

Find a realtor

After the loan originator has given you the go ahead to move forward, consider seeking out a realtor to assist you with house hunting. Having a realtor is a great opportunity for you to view houses on the market, learn a bit about the area, and ask questions.

At HOC, our Preferred Realtor Program enlists local realtors that are educated on HOC’s staff, services, and loan options!

Prepare for Closing Day

So, you’ve snagged your dream home? All that’s left is to attend the closing, which is typically held at an attorney office, sign required documents and get the keys to your new home!

Feel free to reach out to HOC staff to start the homebuying process or with any questions about the process.

Learn more about our loan options, services & more by checking out our YouTube Channel.